Burry: 1907 tog det tre veckor för börsen att bottna

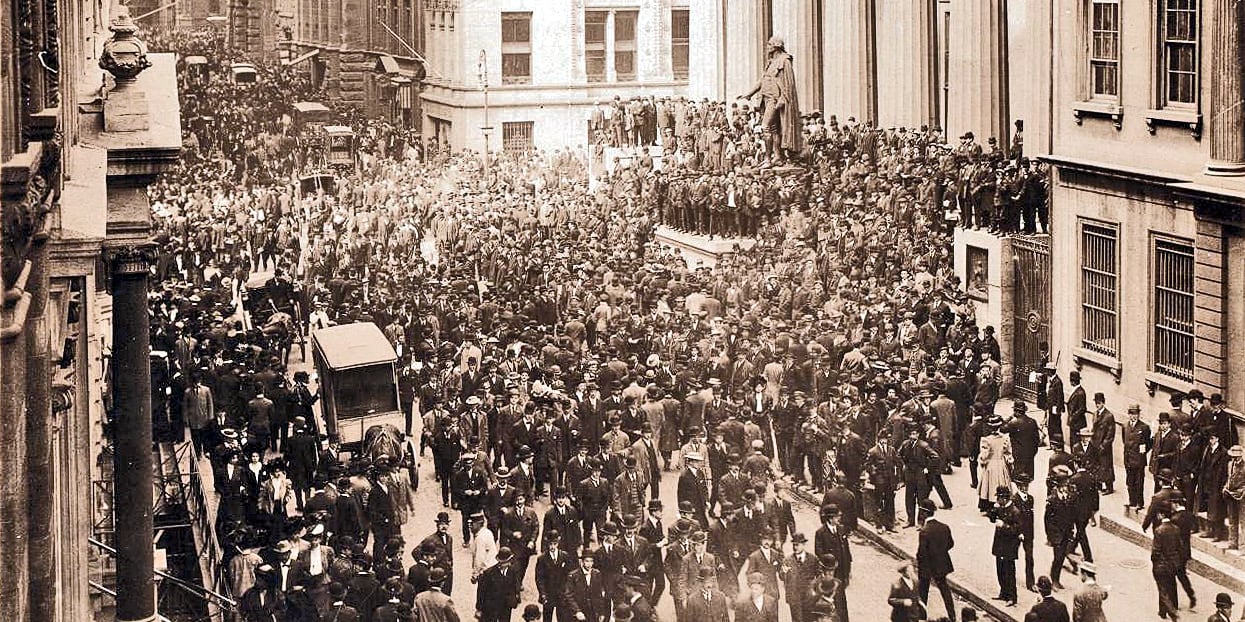

Inflytelserika investeraren Michael Burry tror att de stödåtgärder som amerikanska myndigheter satt in kommer att räcka för att dämpa den senaste veckans turbulens i banksystemet, skriver CNBC. I ett inlägg på Twitter drar han en parallell till den så kallade bankpaniken 1907 och antyder att börsen kan nå botten om några veckor.

”Knickerbocker Trust gick under på grund av riskabla investeringar, vilket skapade panik. Ytterligare två föll kort därefter, och det spred sig. När en rusning påbörjades […] tog JP Morgan ställning. Tre veckor senare hade paniken lättat och marknaden bottnat”, skriver Burry och tillägger:

”Ställning togs i helgen”.

Burry är känd för att han förutsåg den amerikanska bostadsbubblan 2008.

Gör en klok investering – testa Omni Ekonomi

Inflation, högre räntor och stora börsrörelser. Hur stor avkastning vågar vi räkna med ett år som detta? Vilka fällor ska man undvika på börsen? Och inom vilka sektorer finns vinnare?

Med Omnis systerapp Omni Ekonomi får du Sveriges mest heltäckande bevakning av börs- och bolagsnyheter. Lägg därtill att Sveriges främsta aktieexperter svarar på de svåra frågorna och hjälper dig att navigera marknaderna.

Nu får alla Omniläsare chansen till en klok investering – testa Omni Ekonomi i två månader för endast 49 kronor (spara 269 kronor).