Spelteorin prisas återigen av vetenskapsakademin

Spelteorin har återigen belönats av Kungliga vetenskapsakademin. Paul R. Milgroms och Robert B. Wilsons auktionsforskning är en fortsättning på den moderna spelteori som började utvecklas under första halvan av 1900-talet.

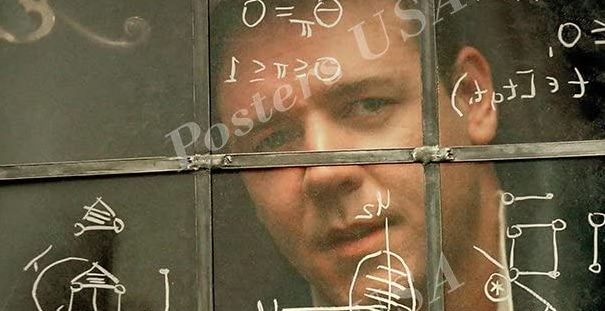

Forskningsfältets kanske mest kända företrädare – matematikern John Forbes Nash som utvecklade den välkända Nashjämvikten – vann priset 1994. Nashs kamp mot schizofreni gestaltas i filmen ”A beautiful mind” från 2001.

En annan tydlig spelteoretiker som vunnit nobelpriset är Thomas Schelling (2005). Men spelteorin har använts av fler pristagare, till exempel Jean Tirole (2014).

Robert B. Wilsons och Paul R. Milgrom har själva gjort en del rena spelteoretiska upptäckter, bland annat Milgroms arbete kring hur spelare kan bygga sig ett ”rykte” vid återkommande spel.

Wilsons arbete med fenomenet ”vinnarens förbannelse” vid auktionsspel framhålls också av Kungliga vetenskapsakademin.

De har fått ekonomipriset tidigare år

Riksbankens ekonomipris till Alfred Nobels minne har delats ut sedan den svenska centralbankens 300-årsjubileum 1969.

De senaste årens pristagare:

2019: E Duflo (Frankrike), A Banerjee (Indien), M Kremer (USA)

2018: W D Nordhaus (USA), P M Romer (USA)

2017: R Thaler (USA)

2016: O Hart (Storbritannien), B Holmström (Finland)

2015: A Deaton (Storbritannien/USA)

2014: J Tirole (Frankrike)

2013: E Fama (USA), L P Hansen (USA), R Shiller (USA)

2012: A Roth (USA), L Shapley (USA)

2011: T J Sargent (USA), C A Sims (USA)

2010: P A Diamond (USA), D T Mortensen (USA), C A Pissarides (Cypern)

2009: E Ostrom (USA), O Williamson (USA)

2008: P Krugman (USA)

Källa: Nobelstiftelsen