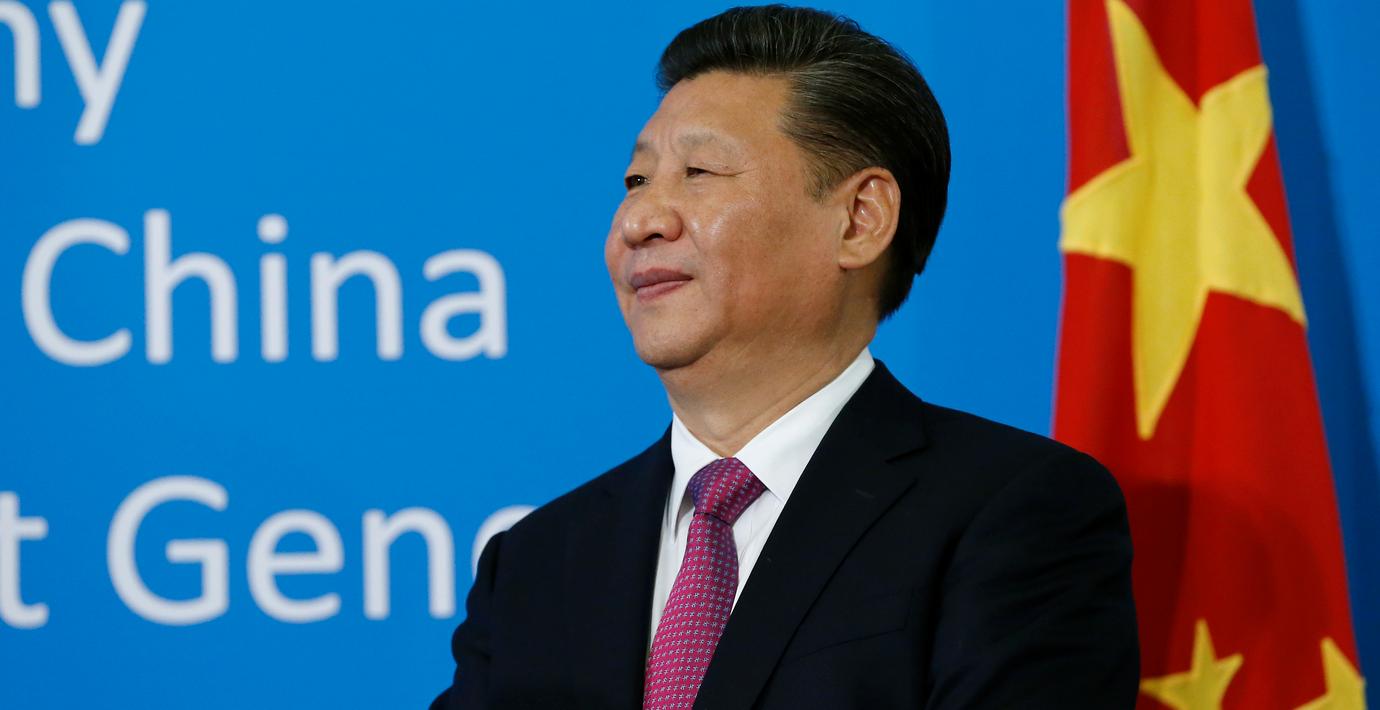

Xi Jinping vill etablera Kinas banker i Genève

Kinas president Xi Jinping för diskussioner med Genève om att etablera de kinesiska bankerna i staden, enligt ett uttalande från stadens ledning på onsdagen skriver Bloomberg. Utvecklingen sker samtidigt som nordamerikanska och europeiska banker söker sig bort från staden, bland annat på grund av försämrad banksekretess.

bakgrund

Schweiziska banksektorn

Wikipedia (en)

Banking in Switzerland is regulated by the Swiss Financial Market Supervisory Authority (FINMA), which derives its authority from a series of federal statutes. The country's tradition of bank secrecy, which dates to the Middle Ages, was first codified in the Federal Act on Banks and Savings Banks, colloquially known as the Banking Law of 1934. The regime of bank secrecy that Swiss banks are famous for came under pressure in the wake of the UBS tax evasion scandal and the 1934 banking law was amended in 2009 to limit tax evasion by non-Swiss bank clients.

In 2015, banks represented 53.3% of the total value added of the Swiss financial sector, totalling CHF 32 billion representing 5.12% of the country's GDP. UBS and Credit Suisse, the two largest banks in Switzerland, were ranked globally at #27 and #29 among banks, with assets of approximately US$941 billion and US$909 billion, respectively.

As of 11 October 2008, the banking industry in Switzerland has an average leverage ratio (assets/net worth) of 29 to 1, while the industry's short-term liabilities are equal to 260 percent of the Swiss GDP or 1,273 percent of the Swiss national debt.

Omni är politiskt obundna och oberoende. Vi strävar efter att ge fler perspektiv på nyheterna. Har du frågor eller synpunkter kring vår rapportering? Kontakta redaktionen