Trump räknar med gehör: ”Jag förstår räntor mycket bättre”

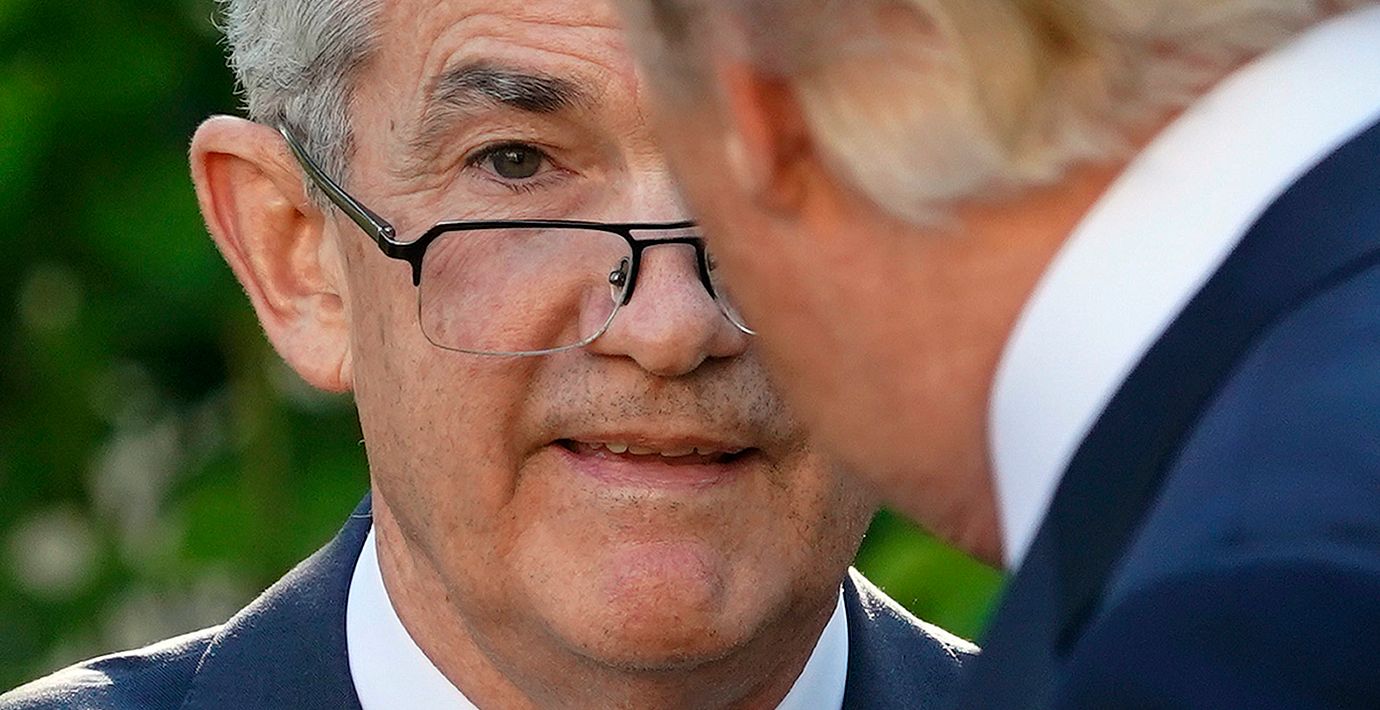

Striden om räntepolitiken i USA har börjat på allvar. Under sitt tal i Davos var beskedet från Donald Trump att han kommer ”kräva” räntesänkningar. Senare på kvällen förklarade presidenten att han förväntar sig gehör från Fed-chefen Jerome Powell i kommande samtal.

– Jag tror att jag förstår räntor mycket bättre än vad de gör. Om jag inte håller med kommer jag att göra det känt, sa Trump under en presskonferens i Vita huset enligt Bloomberg.

Att separera penning- från finanspolitik har varit en norm i många länder sedan 80-talets inflationskris. Grundtanken är att ekonomin missgynnas av politikens ofta kortsiktiga perspektiv.

bakgrund

Centralbankers oberoende

Wikipedia (en)

Central bank independence refers to the degree of autonomy and freedom a central bank has in conducting its monetary policy and managing the financial system. It is a key aspect of modern central banking, and has its roots in the recognition that monetary policy decisions should be based on the best interests of the economy as a whole, rather than being influenced by short-term political considerations.

The concept of central bank independence emerged in the 1920s and was broadly approved by the conclusions of the Brussels International Financial Conference (1920). Since the 1980s, there has been a substantial increase in central bank independence worldwide.

The purpose of central bank independence is to enhance the effectiveness of monetary policy and ensure the stability of the financial system. Independent central banks are better able to carry out their mandates, which include maintaining price stability, ensuring the stability of the financial system, and implementing monetary policy. By being free from political influence, central banks can focus on long-term goals, such as controlling inflation and ensuring stability, rather than responding to short-term political pressures.

Central bank independence can be classified in various ways. One common classification is based on the extent of the central bank's autonomy, which can be either formal or actual. Formal independence refers to the legal provisions that guarantee the central bank's autonomy, such as its mandate, its organizational structure, and the procedures for appointing its leaders. Actual independence refers to the practical independence that the central bank enjoys in practice, taking into account factors such as its political and institutional environment, its relationship with the government, and the level of transparency and accountability in its operations.

Another common classification of central bank independence is based on the extent to which the central bank is free from government control. This can be either formal or actual, and ranges from complete independence to significant government control, with several intermediate levels in between. The People's Bank of China is an example of a central bank subject to Chinese Communist Party control.

Omni är politiskt obundna och oberoende. Vi strävar efter att ge fler perspektiv på nyheterna. Har du frågor eller synpunkter kring vår rapportering? Kontakta redaktionen